Financing Growth & Infrastructure

Global economic growth has been sluggish for several years. While in advanced economies a heightened uncertainty and setbacks to confidence have dampened growth, the economic powerhouses of the emerging economies have lost steam not least because of declining oil and commodity prices.

In 2014, the G20 had agreed to increase global growth by at least two percentage points over the next five years. We are far from reaching this goal. Many countries face considerable investment gaps in infrastructure, research and development, as well as education. While it is vital to ensure sound public finances, we also need to strengthen the basis for future economic growth and jobs.

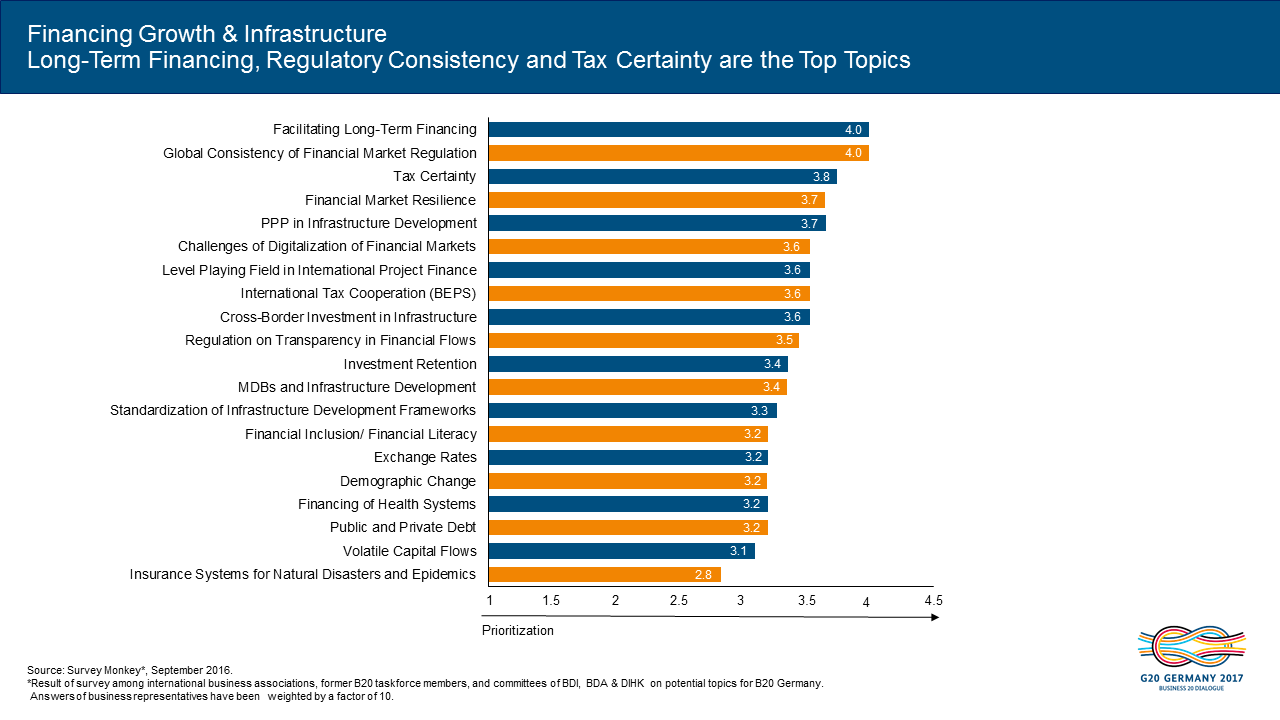

The global economy has come a long way since 2008, when the global financial system stood at the brink of collapse. The financial system has become more resilient. Yet, the International Monetary Fund (IMF) finds that global financial stability risks have risen since October 2015. Financial conditions have tightened, risk appetite has decreased, credit risks have risen, and balance sheet repair has stymied. A lot of work remains to be done. Initiatives, for example, for global regulatory coherence or tax certainty are only a starting point.

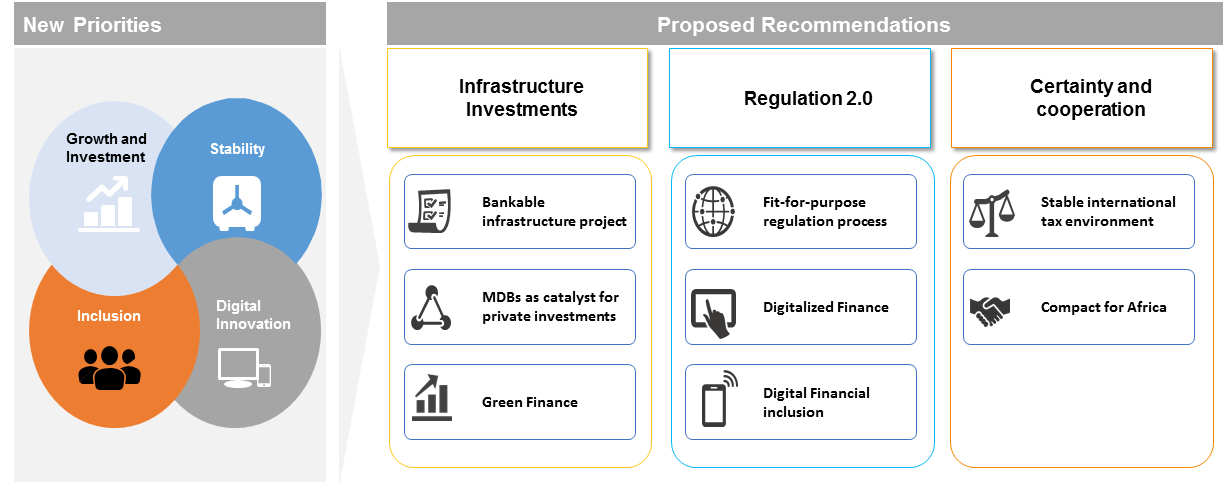

B20 Focal Areas

Infrastructure Investments are of key importance for future growth. The B20 wants to foster the exchange on best practices and calls for capacity building programs to facilitate project planning, with international development banks as the primary tool to expand access to project pipelines for private actors. In order to ensure the sustainability of new projects, green finance needs to be facilitated through streamlined frameworks.

Regulation 2.0 means creating a fit-for-future regulation that embraces digital opportunities and risks. The B20 strives for a right balance between both financial and regulatory innovation, and the necessary coordination it demands internationally, not only to ensure consistency, but also advance financial inclusion.

Certainty and Cooperation is crucial for private investors to invest in the long-term. We call for an international tax environment which prioritizes stability, consistency, and simplification. Moreover, international cooperation in designing model frameworks to facilitate investments into sustainable development projects in emerging markets, especially in Africa, is needed.